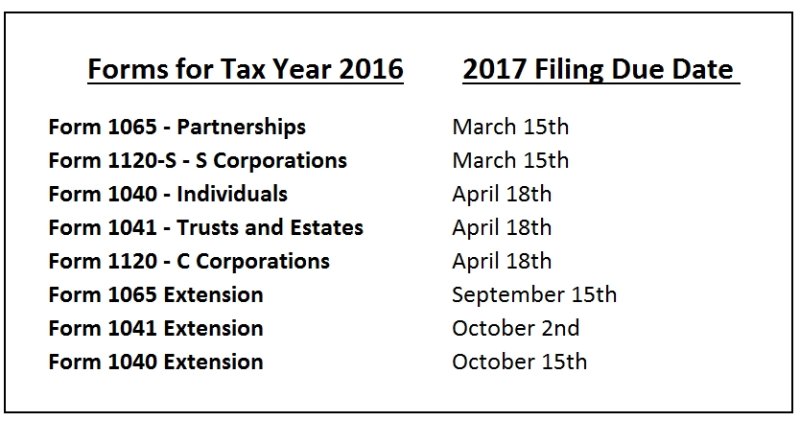

You’ve likely heard already that tax returns needing to be filed for 2016 have new due dates. Legislation passed by Congress in 2015 now takes hold and some regular due dates that fall on the weekend were adjusted. Here is a summary for your reference.

The due date changes with the most impact will likely be those for Partnership tax returns (Form 1065) and C Corporation tax returns (Form 1120). The Partnership returns are due March 15th and C Corporation returns due April 18th. This relatively significant reorganization of due dates is intended to assist individuals with pass-through entities and for them to receive information required to prepare their individual returns in a timelier fashion.

The due date changes with the most impact will likely be those for Partnership tax returns (Form 1065) and C Corporation tax returns (Form 1120). The Partnership returns are due March 15th and C Corporation returns due April 18th. This relatively significant reorganization of due dates is intended to assist individuals with pass-through entities and for them to receive information required to prepare their individual returns in a timelier fashion.

Whenever a regular tax filing date falls on a Saturday, Sunday or a legal observed holiday in DC, the due date for returns is pushed to the next business day.

The information above was designed to provide some basic guidance and is not meant to be exhaustive – there are many unique and less common situations. If you have any questions about these new due dates and the impact on you, please contact us.

Focus on what you do best.

YourBizManager ( www.YourBizManager.com ) can help. You can start the process by sending us an e-mail (info@YourBizManager.com) with your contact information, a list of your needs or by texting or calling 424-246-6006.

Receive a FREE consultation and 50% off.

Contact us today to receive your free consultation and 50% off your first four (4) hours of service. Just mention this post. https://www.yourbizmanager.com/freeconsultation/

About Doris Cristiano & YourBizManager.

About Doris Cristiano & YourBizManager.

As an independent bookkeeper, Doris has been providing flexible business services in Santa Monica and West Los Angeles since 1997. To support Clients’ needs and growth, YourBizManager tailors its services to each unique business situation and works closely with clients at their business or home office. https://www.yourbizmanager.com/about-us/